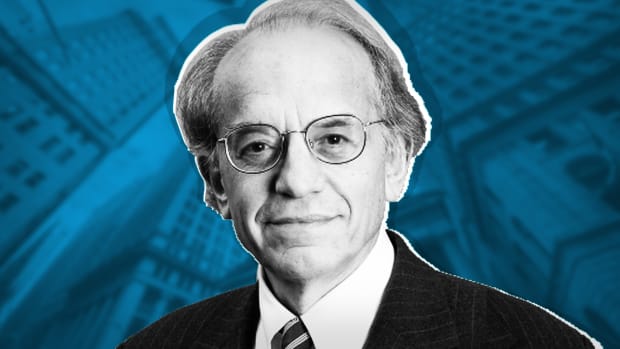

Stocks to Suffer from Inflation, Fed Tightening, Wharton’s Siegel Says

Stocks are going to suffer as inflation heats up and the Federal Reserve is forced to tighten policy faster than expected, market guru Jeremy Siegel says.

“For next year we’re going to have much more inflation,” the finance professor at the University of Pennsylvania’s Wharton School told CNBC. “When you see worse inflation, the Fed is going to be pressured, and that’s going to disturb the market.”

The Fed’s favored inflation indicator, the personal consumption expenditures price index, rose 4.2% year-on-year in July.

Fed officials have indicated that the central bank is likely to begin tapering its bond buying in November and finish by the middle of next year. Half of Fed policymakers predict it will start raising interest rates next year.

But the Fed may have to move faster on tapering to counter inflation, Siegel said.

TheStreet Recommends

Stocks to Suffer from Inflation, Fed Tightening, Wharton’s Siegel Says

Roku Stock Falls; Wells Fargo Notes Sharp Rise in ARPU Estimates

Vermont Recognizes Clean Energy Week 2021

Fed Chief Jerome Powell “opened the door saying, if things get worse, we will have to taper faster. If that happens toward the end of the year, that would rattle the market.”

Siegel’s also concerned that the Fed may react too strongly.

“I worry actually about an overreaction, because a lot of that inflation that we’re going to have, it’s already in the pipeline,” he said.

“The Fed can’t really do anything about it. If they panic and say, oh my god, we’re way behind the curve, let’s jack up rates, that’s bad.

“That will really trouble the market and the economy.”

For now, “the road looks clear ahead for a month or two,” Siegel said. “We could have a market up 10% before another 10% drop.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  JUSD

JUSD  Figure Heloc

Figure Heloc