Cybersecurity firm Darktrace floats at $2.37 billion valuation as shares soar 38% in early trading

- Cybersecurity firm Darktrace hit an opening valuation of £1.7 billion ($2.37 billion) with its London IPO.

- The firm priced its shares at 250p and saw that soar as much as 38% in the opening hour Friday.

- It represents a stronger early performance by a tech company in London than Deliveroo’s IPO in March.

- See more stories on Insider’s business page.

Shares in the cybersecurity firm Darktrace soared as much as 38% when they started trading in London on Friday.

The Cambridge, England-based company, which uses an “AI immune system” to detect abnormalities in a customer’s network, was valued at £1.7 billion, or $2.37 billion, in its initial public offering. Shares were priced at 250 pence in its listing, the midpoint of the range, with the firm raising £165 million. By 7:15 a.m. BST, they were trading at about 350 pence.

Darktrace is the latest high-profile tech listing to take place on the London Stock Exchange this year. Its strong early performance marks a dramatic change from the plunge in Deliveroo’s share price when the food-delivery firm listed in March.

The cybersecurity company is trading under the ticker DARK. Its opening valuation came in lower than the $4 billion that had been previously reported by Reuters.

Darktrace makes money from subscription-based contracts with customers and operates as a “software as a service” business. It counts Oracle, Quest, and Imperva among its blue-chip clients.

One of Darktrace’s earliest investors, the billionaire Autonomy founder Mike Lynch, is fighting extradition to the US on charges of fraud related to the sale of Autonomy to HP in 2011. He is also awaiting a UK High Court verdict on a civil claim filed by HP. Lynch has denied wrongdoing.

Lynch’s investment firm Invoke is Darktrace’s top investor, though the company has said he no longer has any involvement in the company and is no longer on the board.

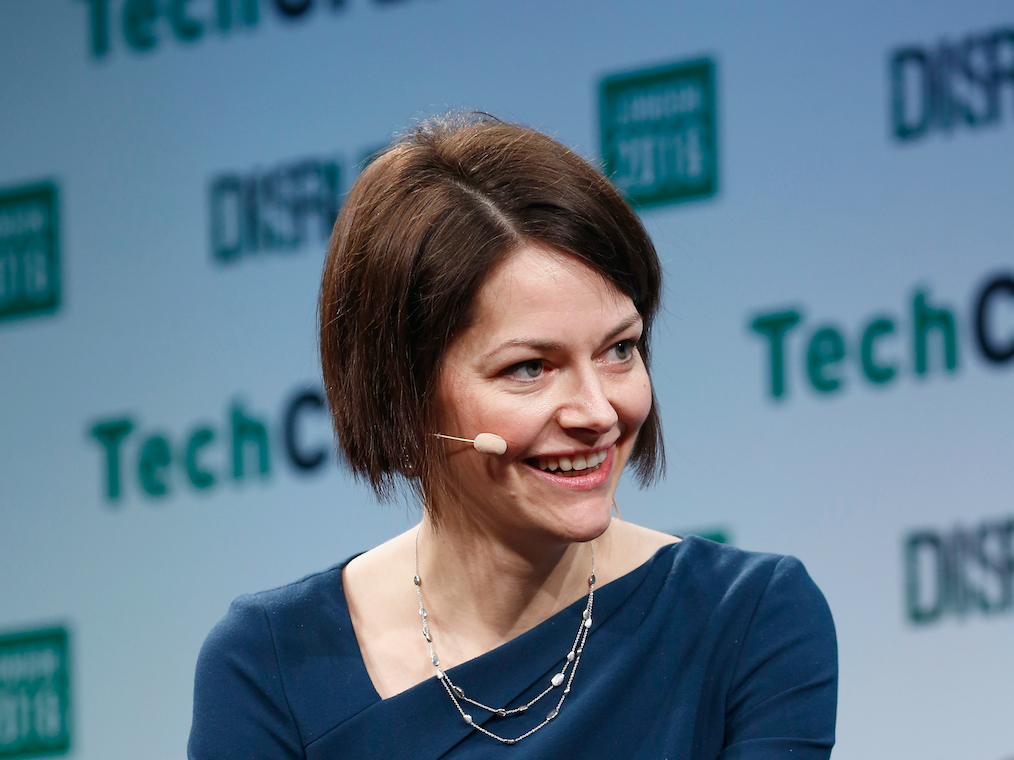

Poppy Gustafsson, the CEO of Darktrace, thanked a host of stakeholders in a statement Friday morning, including Invoke.

“We owe much gratitude to the Invoke team for their pivotal role in the vision, technology, positioning and operational input in the early years without which today’s success would not have been possible,” she said.

The makeup of Darktrace’s public offering initially caused some confusion, with the company stating its offer size would be worth around £165.1 million or approximately 9.6% of its shares.

This represents a significantly lower figure than the 20% it had initially said would be made available in documents earlier in the month.

However, it is understood the company will still exceed a 20% free float with the remaining balance being made up of existing investors.

IPO restrictions in the UK typically stipulate that a company listing on the premium segment of the London Stock Exchange, as Darktrace did, must put forward 25% of their shares with some exemptions allowed from the Financial Conduct Authority. A recent report into the rules around listings by Lord Hill recommended the threshold be lowered to 15% in order to make the UK a more attractive location to make a public bow.

As yet, the Hill recommendations are not law.

Vasile Foca, a managing partner and cofounder of the Darktrace backer Talis Capital, said the company remained “incredibly impressed” with the vision of the company.

“With cybercriminals continuing to ramp up the sophistication of their attacks, cybersecurity has become increasingly critical infrastructure for every business, particularly in the current work-from-home era,” Foca said.

“Darktrace’s state-of-the-art AI cyber technology provides essential protection to thousands of businesses globally.”

Hussein Kanji, a partner at the venture-capital firm Hoxton Ventures, said the firm’s early investment had returned a multiple of his first fund. “This market is still in its early days and we believe they have a bright journey ahead,” he said.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Cardano

Cardano