Asia shares set to rise as broader worries about hedge fund default ease

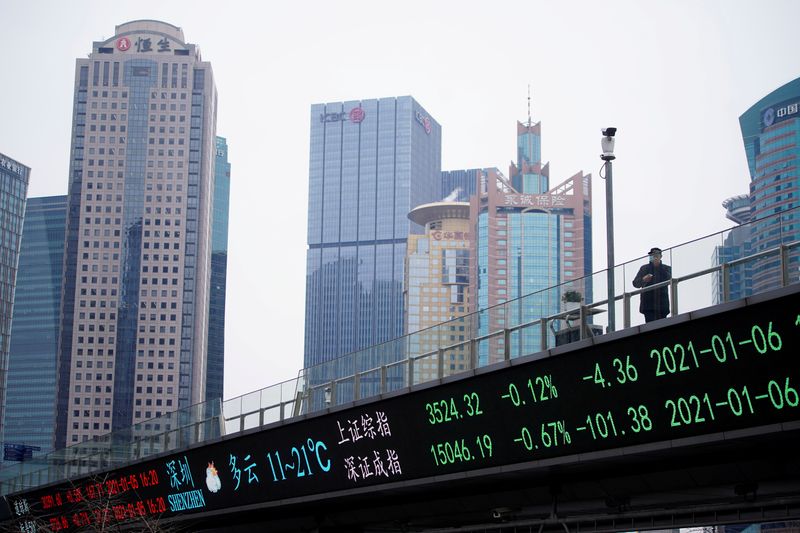

© Reuters. FILE PHOTO: A man stands on an overpass with an electronic board showing Shanghai and Shenzhen stock indexes in Shanghai

© Reuters. FILE PHOTO: A man stands on an overpass with an electronic board showing Shanghai and Shenzhen stock indexes in Shanghai

By Ritvik Carvalho

LONDON (Reuters) – Global stock markets rose on Tuesday as investors shook off worries about a hedge fund default that hit international banking stocks overnight and remained focused on the global COVID-19 vaccination programme.

European stocks opened higher with the regional index up 0.5%. 100 rose 0.6%, and Italy’s rose 0.5% each, and 40 rose 1%. ()

MSCI’s All Country World Index, which tracks stocks across 49 countries, traded flat.

stock futures were off 0.1%. ()

Sentiment in Asia was mixed early, then turned positive, with most of the region’s major markets trading higher.

Nomura and Credit Suisse (SIX:) are facing billions of dollars in losses and regulatory scrutiny after a U.S. investment firm, named by sources as Archegos Capital, defaulted on equity derivative bets, putting investors on edge about who else might be exposed.

Nomura shares were down a further 1.1% Tuesday after dropping as much as 16% on Monday, when it revealed it could take a $2 billion loss from the hedge fund fallout.

“From a market perspective with contagion looking limited … despite the news flow of further forced liquidations and prime brokerage losses, this looks at this stage to be a positioning- driven sell-off in U.S. futures and various single stock names,” said Eleanor Creagh, market strategist at Saxo Bank.

Creagh added that further forced deleveraging was still a risk if prime brokers tighten margin requirements.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.6% higher. Mainland China’s CSI300 index rose 1%.

Hong Kong’s gained 1.2% to reach 28,668, driven up by a rebound in the city’s tech stock index. That index has been under pressure from concern over the Chinese government’s move to increase regulation of those companies.

was flat, dragged down by Nomura’s share price weakness. Australia sounded a weaker tone when the S&P/ASX200 closed down 0.9% at its lowest point for a week.

Credit Suisse’s Asia Pacific senior investment strategist Jack Siu said the prospect of Asian travel bubbles had sparked enthusiasm among some investors in the region.

“Tourism-dependent Asian economies will benefit,” he said.

Hong Kong’s commerce secretary, Edward Yau, flagged Monday the government had restarted talks with Singapore to re-establish a potential travel bubble between the cities.

Investor sentiment was still closely tied to the pace of the global vaccine rollout, said Citigroup (NYSE:) equity derivative solutions director Elizabeth Tian.

“Investors will also be watching the number of COVID cases as rises in Western Europe and the Philippines sees the return of renewed restrictions, while vaccination attempts threaten to stall amidst supply constraints and vaccine nationalism,” Tian said.

“While restrictions are increased in Europe, the UK will be relaxing stay-at-home rules,” she added.

Wall Street on Monday pared early losses driven by the banking sector on fears that issues from the downfall of Archegos could spread throughout the banking sector.

The rose 0.3%, the S&P 500 lost 0.09% and the dropped 0.6%.

Benchmark U.S. 10-year yields hit 1.7760%, their highest since January 2020.

In currencies, the dollar rose to its highest in a year against the yen, boosted by the spike in Treasury yields. The euro fell to $1.1751 against the dollar for the first time since Nov. 11. [FRX/]

Oil prices fell as the Suez Canal opened up after days closed by a grounded supercarrier and focus turned to an OPEC+ meeting this week where the extension of supply curbs may be on the table amid new coronavirus pandemic lockdowns. [O/R]

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Figure Heloc

Figure Heloc  Lido Staked Ether

Lido Staked Ether