FOREX ECONOMIC CALENDAR

The most essential trading tool for all traders.

Economic News Calendar Tool

Trading on the FX market is very challenging, both for new and experienced traders. In other words, going into forex trading without a wide range of information, especially of economic nature, and the adequate analysis of such information is equal to gambling all the money away. Hence, in their trading endeavors, traders heavily really upon trading tools and their usage for conducting fundamental analysis. One such tool is the Economic Calendar.

What is a Forex Economic Calendar?

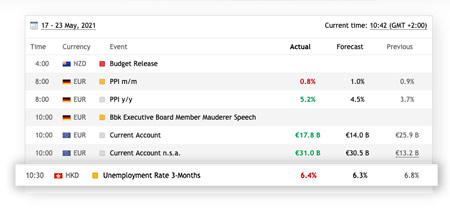

Forex Economic Calendar is one of the most essential trading tools which allows traders to learn about important economic information which is to be released at specific dates, and which can affect the currency rates and market volatility. This tool is usually offered by forex brokers and financial websites completely free.

The economic calendar can include information related to GDP, unemployment rate, consumer price index, the NFP report which shows how many new jobs were added in the US excluding certain categories (farm, government employees, etc.) and much more. All of these indicators can impact the valuation of the country’s currency which traders need to take into account. In addition, another important piece of information traders can gather from the economic calendar is the dates on which central banks would have major meetings or news announcements, as their actions in maintaining pricing stability within their market such as interest rate adjustments, can easily impact the value rate of the currency in comparison to other currencies.

The events within a calendar are graded from low, over moderate (medium) to high depending on their impact on the market and are usually related to the market volatility. As the Economic Calendar is listing timings for all announcements and currencies that can be affected, all traders are advised to check it before they open any positions.

How to Read and Use a Forex Economic Calendar?

In order for traders to get the most out of this trading tool, they need to understand how to filter out the information they need (to encompass and process all information is not feasible) and how to read the extracted information.

Although design of Forex Economic Calendars can differ from provider to provider, what is common for all calendars is:

- Time filtering for the tracked economic events. For instance, the given filters are usually last and next week, today and tomorrow; however, traders can also choose their own desired time span.

- Categorization of events to lows, medium and high in terms of their impact.

- Time zone filtering which enables traders to filter events based on their trading time zone

- Currency filters.

After applying the adequate filters, traders will be able to see only the information and indicators related to their desired currency pairs and time periods. At this point they will need to read into this data properly. For instance, if a trader is mostly interested in Euro currency he may decide to filter out data from the previous period and get an idea of the direction of the economic indicators. Let’s say that the ECB (European Central Bank) Eurozone inflation rate forecast was published to be 0.9%, yet the previous release was at 1.4%. Given that the ECB goal is to achieve close to 2.2%, from this information a trader could conclude that the rate is even further away from its set mark, hence they can expect more pressure on EUR over the next period. However, learning how to interpret various economic indicators does take time and diligence.

Trading Conditions

What Are the Benefits of Using a Forex Economic Calendar?

Besides providing invaluable information which can be used to forecast currency/market movements, Economic Calendar can also serve as the source of information for traders which will indicate when it is the time to possibly avoid trading. For instance at the time of high level impact economic announcements, some traders can avoid trading due to high expected market volatility and higher risk. Therefore traders often consult the calendar in order to determine when to close their open positions and when to avoid opening new.

Therefore some of the most important benefits of using the Forex Economic Calendar include:

- Being able to plan trading activities ahead

- Extracting the most relevant economic indicators by customizing filters and search options

- Managing trading risk more effectively.

You May Also Like

You May Also Like

Recent Posts

-

Epstein Files Photo Shows Mark Zuckerberg and Elon Musk At Dinner

February 9, 2026 -

Let’s Think About The Imagination Layer That AI Can’t Replace

February 9, 2026

Categories

- Commodities (1,115)

- Coronavirus (221)

- Cryptocurrency (35)

- Economic Indicators (763)

- Economy (1,854)

- Forex (637)

- General (95)

- General (5)

- Geopolitical Events (1,336)

- Latest News (1)

- Most popular (2)

- Stock Markets (719)

- Technology (5,608)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  JUSD

JUSD  Dogecoin

Dogecoin