Biden to express concern over Nippon Steel’s deal for U.S. Steel, source says

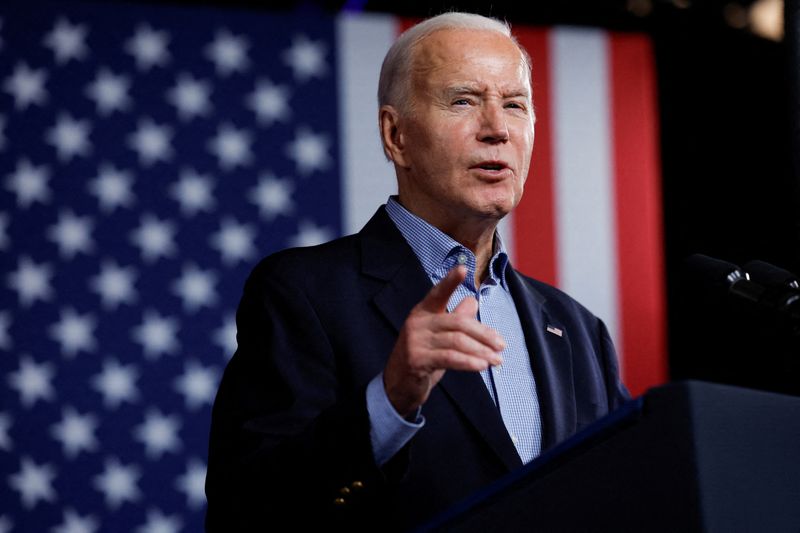

© Reuters. U.S. President Joe Biden speaks during a campaign event at Pullman Yards in Atlanta, Georgia, U.S. March 9, 2024. REUTERS/Evelyn Hockstein/File Photo By Trevor Hunnicutt

(Reuters) -U.S. President Joe Biden plans to express concern over Nippon Steel’s proposed $14.9 billion purchase of U.S. Steel, a person familiar with the matter told Reuters, pushing the U.S. company’s stock 12% lower on bets the deal could face greater political opposition.

In December, Nippon Steel clinched a deal to buy the 122-year-old iconic steelmaker for a hefty premium, betting that U.S. Steel will benefit from the spending and tax incentives in Biden’s infrastructure bill.

However, several Democratic and Republican U.S. senators have criticized the deal, citing national security concerns or raising questions about why the two companies did not consult U.S. Steel’s main union ahead of the announcement.

The White House said in December the deal needed to be carefully scrutinized given U.S. Steel’s core role in producing a material that is critical to national security. It declined to comment on Wednesday.

Nippon Steel has said it believes the acquisition will be beneficial to all stakeholders. It was not immediately available for a comment outside regular hours.

Biden will issue a statement about Nippon’s planned acquisition before Japanese Prime Minister Fumio Kishida arrives for a state visit in Washington on April 10, the person said.

U.S. officials and lawyers have drafted the statement and the White House has privately informed the Japanese government of Biden’s decision, according to the Financial Times, which first reported the news.

Japan’s Washington embassy did not immediately respond to requests for comment.

U.S. Steel, founded in 1901 by some of the biggest U.S. magnates, including Andrew Carnegie, J.P. Morgan and Charles Schwab (NYSE:SCHW), became intertwined with the industrial recovery following the Great Depression and World War Two.

Last year, the Pittsburgh-based company launched a formal review of its strategic options after rebuffing a takeover offer from steelmaker Cleveland-Cliffs (NYSE:CLF).

Its shares had come under pressure following several quarters of falling revenue and profit, making it an attractive takeover target for rivals looking to add a maker of steel used by the automobile industry.

U.S. Steel was not immediately available for a comment on Wednesday. Its shares were trading at $41.12, below Nippon’s offer of $55 per share.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether