Japan finance minister declines to say whether government intervened to prop up yen

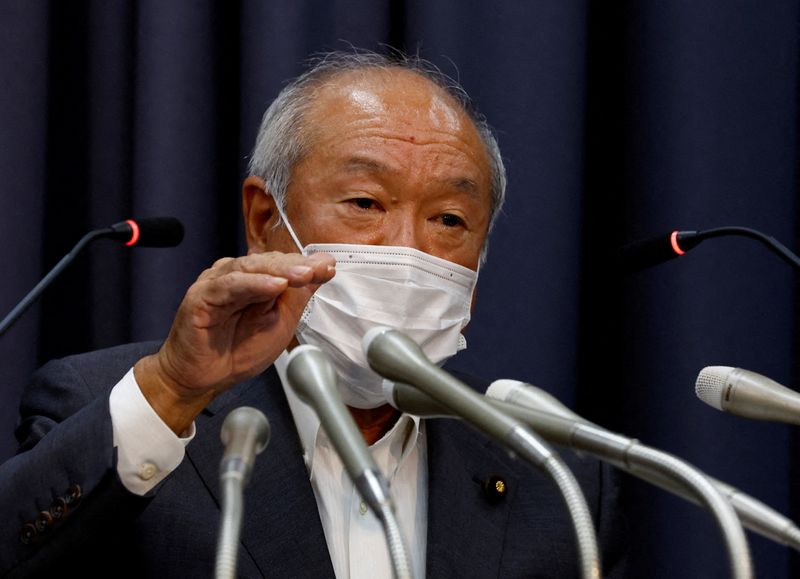

© Reuters. FILE PHOTO: Japan’s Finance Minister Shunichi Suzuki speaks at a news conference after Japan intervened in the currency market for the first time since 1998 to shore up the battered yen in Tokyo, Japan September 22, 2022. REUTERS/Kim Kyung-Hoon MS +3.42% Add to/Remove from Watchlist Add to Watchlist Add Position Position added successfully to:

Please name your holdings portfolio Type: BUY SELL Date: Amount: Price Point Value: Leverage: 1:1 1:10 1:25 1:50 1:100 1:200 1:400 1:500 1:1000 Commission: Create New Watchlist Create Create a new holdings portfolio Add Create + Add another position Close MUFG +3.96% Add to/Remove from Watchlist Add to Watchlist Add Position Position added successfully to:

Please name your holdings portfolio Type: BUY SELL Date: Amount: Price Point Value: Leverage: 1:1 1:10 1:25 1:50 1:100 1:200 1:400 1:500 1:1000 Commission: Create New Watchlist Create Create a new holdings portfolio Add Create + Add another position Close By Tetsushi Kajimoto and Yoshifumi Takemoto

TOKYO (Reuters) – The Japanese yen was whipsawed in early Monday trading on suspected intervention by Tokyo for the second straight day, but the efforts to slow the currency’s relentless slide was blunted by a dollar riding a wave of yield-driven and safe-haven demand.

Japanese authorities again declined to confirm whether they had intervened, but the price action strongly suggested they had.

Early on Monday, the Japanese currency made a thumping 4 yen jump to 145.28 per dollar, indicating currency authorities had stepped in for a second successive day, after a similar move by Tokyo on Friday.

The yen, however, dropped back to near 148, highlighting the widening interest rate differentials between the United States and Japan, as the Federal Reserve extends its policy tightening campaign in contrast to the BOJ’s commitment to keep rates ultra-low.

“We won’t comment,” Masato Kanda, vice finance minister for international affairs, told reporters at the Ministry of Finance (MOF), when asked if they intervened again on Monday.

“We are monitoring the market 24/7 while taking appropriate responses. We’ll continue to do so from now on as well.”

On Saturday, sources told Reuters the dollar’s plunge by as much as by 7 yen overnight on Friday was caused by authorities’ yen-buying action.

On Sept. 22 Tokyo confirmed that it stepped into the market to prop up the yen for the first time since 1998. However, since then authorities have remained silent on whether they had made any further attempts to support the currency.

Traders expect the intervention will only have modest success.

“In the past crises involving British pound and Italy’s lira, authorities have ended up failing to defend their currencies. Likewise, Japan’s stealth intervention only has limited effects,” said Daisaku Ueno, chief FX strategist at Mitsubishi UFJ (NYSE:MUFG) Morgan Stanley (NYSE:MS) Securities.

“Strength in the dollar is the biggest factor behind the weak yen. If the United States shows signs of its rate hikes peaking out and even cutting interest rates, the yen would stop weakening even without intervention.”

Finance Minister Shunichi Suzuki repeated that excessive currency moves were undesirable.

“We absolutely cannot tolerate excessive moves in the foreign exchange market based on speculation,” he told reporters at the finance ministry. “We will respond appropriately to excess volatility.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether